Car crashes happen far too often in San Antonio, and the numbers prove it. Understanding just how big of an issue this is can shed light on why hiring a San Antonio car accident attorney is so important. Here are some eye-opening car accident statistics coming out of San Antonio:

In this comprehensive guide, we’ll walk you through everything you need to know after a car accident in San Antonio. You’ll find out why Jim Adler & Associates is a top choice for injury victims, learn important Texas car accident laws, get practical tips on what steps to take after a crash, and understand how a lawyer can help you deal with insurance companies.

We’ll also cover San Antonio accident statistics, common accident types and injuries, what kind of compensation you might recover, and answer frequently asked questions in our FAQ section. Our goal is to provide clarity and confidence as you consider your legal options.

A rear-end collision on a rainy day left our young client with herniated discs in her neck and lower back. After months of conservative therapy failed, she underwent a spinal fusion to address her lower back pain, but complications from that procedure ultimately required a second spinal surgery. She was facing six-figure medical bills and a lifetime of medical complications while she was still in her 20s, but we recovered enough money to give her a fresh start.

The Verdict: $1,850,000

There are several ways a San Antonio car accident lawyer can help you after you’ve been in an accident. Here are some of them:

The best time to speak with a San Antonio car accident lawyer is immediately after your accident. Acting quickly ensures your rights are protected, evidence is preserved, and your claim gets off to a strong start.

Car accidents can cause a wide range of injuries, from minor cuts to life-altering conditions. Here are some of the most common injuries associated with auto accidents in San Antonio:

1. Whiplash

A neck injury caused by the rapid back-and-forth movement of the head.

2. Cuts, Lacerations, and Bruises

Result from broken glass, sharp objects, or impact with vehicle components.

3. Soft Tissue Injuries

Includes sprains, strains, and contusions, often affecting muscles, ligaments, and tendons.

4. Broken or Fractured Bones

Commonly involve arms, legs, ribs, and facial bones due to the impact of the collision.

5. Spinal Cord Injuries

Can lead to partial or complete paralysis, depending on the severity of the damage.

6. Traumatic Brain Injuries (TBI)

Includes concussions and more severe brain injuries caused by head trauma.

7. Serious Burns

Occur when fires, hot surfaces, or chemical spills are involved in the accident.

8. Severe Blood Loss (Exsanguination)

A critical condition caused by excessive bleeding, often requiring immediate medical attention.

Car accident injury claims in San Antonio are governed by Texas state law. If you’re pursuing compensation, it’s important to know the basics of how Texas laws and procedures will affect your case. Here are the key Texas car accident law essentials:

Texas Is an “At-Fault” State: Texas follows a traditional fault-based system for car accidents. This means the driver who is responsible for causing the crash is liable for the damages. Unlike “no-fault” states, Texas does not require you to go through your own insurance for injury claims (except for any Personal Injury Protection you might carry). Instead, you typically file a claim against the at-fault driver’s insurance, or sue the at-fault driver, to recover your losses. All drivers in Texas are required to carry liability insurance at minimum limits of $30,000 per person injured, $60,000 per accident for bodily injury, and $25,000 for property damage (30/60/25 coverage).

Comparative Negligence – 51% Bar Rule: Sometimes more than one party is partly at fault for an accident. Texas uses a modified comparative negligence rule (also known as proportionate responsibility). Under Texas law, you can still recover damages as long as you were 50% or less at fault for the accident. However, your compensation will be reduced by your percentage of fault. For example, if you are found 20% at fault, you could recover 80% of your total damages (so a $100,000 claim might yield $80,000). If you are 51% or more at fault, you are barred from recovering anything.

Statute of Limitations: Texas has a time limit of 2 years for filing a car accident injury lawsuit in most cases. This deadline (the statute of limitations) typically starts from the date of the accident. For example, if you were in a crash on January 1, 2025, you would usually have until January 1, 2027 to file a lawsuit. If you try to sue after the 2-year window has passed, the court can dismiss your case and you lose the opportunity to recover anything.

Police Reports and Local Procedure: In Texas, if an accident causes injury, death, or significant property damage, it should be reported to the police. In San Antonio, SAPD (San Antonio Police Department) will usually respond to 911 calls for traffic crashes within the city. The investigating officer will prepare a CR-3 Peace Officer’s Crash Report, commonly just called a police accident report. This report includes important details like the parties involved, vehicle positions, diagram of the scene, and any citations or initial fault determinations. While the police report itself isn’t automatically evidence of fault in court, it carries a lot of weight with insurance companies. Find out how to obtain a copy of the SAPD report for your accident and use it in handling your claim.

Understanding these legal basics sets the stage for your claim. Texas law gives you the right to seek full compensation from the negligent driver, but it comes with responsibilities like filing on time and proving fault. An experienced San Antonio car accident lawyer will make sure all the legal i’s are dotted and t’s are crossed, so you can focus on healing.

Car accidents come in many forms, each with unique causes, risks, and outcomes. Here are the most common types of auto accidents that we handle in San Antonio:

The moments and days after a car accident are critical. What you do (and don’t do) can significantly affect your health, safety, and legal claim. It’s hard to think straight in a crisis, so keep this step-by-step guide as a reference. Here’s what to do after a car accident in San Antonio:

Ensure Safety and Call 911: Your first priority is safety. Check yourself and others for injuries. If anyone is hurt or if there’s significant damage, call 911 immediately. In San Antonio, this will alert SAPD and EMS. Even for a minor fender-bender, calling the police is often a good idea to get an official report.

Tell the dispatcher your location as precisely as possible (street names, landmarks, or mile markers – be descriptive like, “I’ve been in a car crash on Loop 410 southbound at the McCullough exit”).

If you’re in the flow of traffic and your vehicle is drivable, you may carefully move to the shoulder or a safe area to prevent another collision. If the cars are disabled, turn on your hazard lights and stay clear of traffic. NEVER FLEE THE SCENE – not only is it illegal, but it could also forfeit your rights. Wait for the police and medical help to arrive.

Get Medical Help (Even if You Feel Okay): Car accidents release adrenaline, which can mask pain. You might feel “fine” immediately after a crash, only to discover injuries hours or days later. Always prioritize getting a medical evaluation as soon as possible.

When EMS arrives, let them check you out. If you have any hint of injury, it’s wise to go to the emergency room or an urgent care clinic the same day. This ensures you receive proper treatment and documents your injuries. Common car accident injuries like whiplash, concussions, or internal injuries may not show obvious symptoms at the scene – a doctor can identify these.

Follow-up with your doctor in the days after. Aside from protecting your health, prompt medical treatment creates records that tie your injuries to the accident, which is vital for any claim.

Gather Information and Evidence: If you are able to do so safely, collect as much information at the scene as you can. Exchange contact and insurance details with the other driver(s) involved. Get their name, phone number, address, driver’s license number, license plate, and insurance company and policy number. If there are any witnesses, politely ask for their names and phone numbers as well – independent witness statements can be extremely helpful later.

Take photos or videos with your phone: capture the vehicle damage, the positions of the cars, skid marks or debris, the surrounding area (traffic signs, lights, road conditions), and any visible injuries. These pictures can preserve evidence that might be cleaned up or forgotten by the time a case goes to court.

If the other driver is behaving erratically or under the influence, try to video it (discreetly and safely) or note it down – and definitely inform the police officer. Every piece of evidence you gather could become a piece of the puzzle in proving what happened.

Don’t Admit Fault or Apologize: While at the scene and afterward, be mindful of what you say. Be honest with police about the facts but avoid volunteering assumptions like “I was probably going a bit fast” or “I didn’t see you coming, I’m so sorry.” Such comments can be misconstrued as admitting fault.

Even if you feel you might be partially to blame, there may be factors you’re unaware of (maybe the other driver was texting or ran a red light). It’s best to stick to factual observations when talking to police, and let the investigation uncover the cause.

On the same note, when speaking to the other driver, it’s fine to ask if they are okay or need help, but NEVER say “It was my fault” or apologize for the accident. Simply exchange info and let the authorities handle the discussion of fault.

Obtain the Police Accident Report: The accident report that the responding officer creates is a key document for your claim. In the chaos of the accident scene, be sure to note the police officer’s name and badge number and ask how to get a copy of the report (they might give you a card or slip with a report ID number).

In San Antonio, once the report is ready (usually within a few days), you can request it. SAPD offers multiple ways to obtain your accident report: you can request it online via the SAPD Records portal, go in person to the SAPD Records Office (315 S. Santa Rosa, San Antonio, TX 78207) with a valid ID, or send a request by mail. There is a small fee (usually ~$6).

Alternatively, Texas DPS/TxDOT also provides crash reports online for a fee. The report will include the officer’s findings, diagrams, and any citations (if the other driver was ticketed for speeding or DWI). This is crucial evidence. For more details, see our guide on Understanding Car Accident Police Reports.

Notify Your Insurance Company: Texas law (and your insurance policy contract) typically requires that you report any accident to your own auto insurance company promptly.

Many policies say you should report “as soon as practicable” or within 24 hours if possible. Call your insurance’s claims phone number and tell them the basic facts: where and when the accident happened, who was involved, and that police responded. Do not give a detailed recorded statement yet and do not speculate about fault – you can simply say the incident is under investigation. You should also not yet discuss your injuries in detail or agree to any settlement. Just open the claim.

If the other driver was clearly at fault, your insurer will usually contact their insurer to pursue subrogation, but you will likely be dealing with the at-fault party’s insurance soon as well. Early notification is important to preserve your coverage (for example, if you later need to use your uninsured motorist or personal injury protection coverage).

However, before you give any in-depth statements or sign anything, consider getting legal advice to avoid saying something the insurance could use against you later. (If you’ve already hired an attorney, your lawyer can notify the insurance companies and handle communications for you.)

Consult a San Antonio Car Accident Lawyer: Finally, seek legal guidance early. A personal injury lawyer who handles car accidents can significantly improve your ability to recover full compensation. Most offer a free consultation, so it costs nothing to learn your rights.

An attorney can advise you on pitfalls to avoid (such as lowball settlement offers or tricky questions from adjusters) and can take over the legal legwork so you can focus on healing. If you decide to hire the lawyer, they will immediately start protecting your interests – preserving evidence, interfacing with insurers, and, if needed, arranging medical care on a lien basis (meaning you pay later from the settlement).

There is no downside to at least talking with a lawyer about your accident. Even if you’re not sure you want to pursue a claim, a consult can help you understand the process and make an informed decision.

Trying to handle a car accident injury claim raises a lot of questions. Below we answer some of the most commonly asked questions clients ask. If you have a question not covered here, feel free to reach out.

Hiring us costs nothing upfront. Jim Adler & Associates (like most personal injury firms) works on a contingency fee basis. This means we do not charge any hourly fees or retainer. Our payment is a percentage of the settlement or verdict we obtain for you at the end of the case. If we don’t recover money for you, you owe us $0 in attorney’s fees. This arrangement allows everyone, regardless of finances, to afford a quality lawyer.

The timeline of a car accident case can vary widely. Some cases settle in a few months; others can take a year or more, especially if a lawsuit and trial become necessary.

Here’s a general breakdown: If your injuries are minor and liability is clear, once you finish treatment and we send a demand, the insurance might agree to a fair settlement within a few months. However, we usually don’t want to settle until you are healed or at least know the full extent of your injuries. Rushing a settlement while you’re still treating can be dangerous because you might discover complications later and you can’t go back for more money. So, the medical recovery phase is a big chunk of the timeline – it could be a few months or longer for serious injuries. After we present a settlement demand, negotiations might take a few weeks to a couple of months. If a settlement is reached, the case ends there.

If the insurance company won’t offer a reasonable amount, we’ll file a lawsuit. Once in litigation, the timeline extends. In Bexar County courts, it might take anywhere from around 12 to 18 months (on average) from filing suit to trial date, though many cases settle at some point during that process. There are phases like discovery (exchange of information, depositions) that take time. We try to move things along as quickly as possible, but also thoroughly – we won’t shortcut your case just to settle faster.

It’s also worth noting that complex cases (e.g., multi-vehicle accidents or those with disputed fault) can take longer because more investigation is needed. Conversely, straightforward cases with clear fault and sufficient insurance can resolve quicker. Every case is unique. We understand that you want closure and compensation promptly, so we work efficiently. Many car accident cases that don’t go to litigation get resolved in under a year. Many that are litigated still settle before trial, though sometimes not until shortly before the trial date when the insurance finally gets serious.

We won’t unnecessarily delay your case, but we also won’t settle for pennies on the dollar just for speed. We keep you informed throughout, and if you ever wonder about the status or what’s next, you can always ask us. We know waiting can be frustrating, but patience can pay off in terms of a better result. (One tip: help your case move faster by promptly providing any information or documents your lawyer requests, and keeping your appointments – this avoids delays.) Remember, Texas’s statute of limitations is 2 years, so in any event, the case must be filed before that expires.

Unfortunately, a significant number of drivers in Texas have no insurance or too little insurance (liability limits) to fully cover the damage they cause. It’s estimated that around 12–20% of Texas drivers are uninsured – roughly one in six drivers (and growing). If you are hit by an uninsured driver (no insurance at all) or an underinsured driver (they have some insurance but not enough to pay for all your losses), here’s how we handle it:

Uninsured Motorist (UM) / Underinsured Motorist (UIM) Coverage: First, check your own auto insurance policy for “UM/UIM” coverage. In Texas, insurance companies are required to offer this coverage to you (though you can reject it in writing). If you have UM/UIM coverage, it steps into the shoes of the at-fault driver’s insurance. For example, if you have $50,000 in UM coverage, you can make a claim with your own insurer up to $50k for your damages if the other driver has no insurance. It doesn’t make your rates go up (you paid premiums for this protection). We have extensive experience handling UM/UIM claims. Sometimes your insurer will still try to contest the value of the claim – in essence, you might be “fighting” your own insurance for fair payment – and we can advocate for you in that scenario (even file a UM lawsuit if needed, where legally your insurance takes on the role of the defendant). The good news is, if you have decent UM/UIM limits, you have a source of recovery even when the other driver broke the law by not having insurance.

Personal Injury Protection (PIP): Additionally, check if you have PIP coverage (another optional coverage in Texas, typically $2,500 or $5,000). PIP will pay for your medical bills and some lost wages, regardless of fault, and is very useful when the other driver is uninsured or can’t be found (hit-and-run). It’s not a lot, but it helps. We can help you file for PIP benefits and coordinate so that it doesn’t negatively affect other aspects of your case.

Suing the At-Fault Driver Personally: If the at-fault driver has no insurance or too little, we can consider a direct lawsuit against them to go after their personal assets. Realistically, many people who don’t carry insurance also don’t have significant assets (like home equity, savings, etc.) to collect against – but there are exceptions. We will investigate the individual’s asset situation. If they have a good job or property, a judgment could potentially be collected over time. However, Texas has strong protections for debtors (homestead exemption, wage garnishment limits, etc.), so collecting from an uninsured individual can be challenging. We’re upfront about this – we don’t want to spend your time and effort on a case that is not economically viable. If there’s a path to recovery, we’ll pursue it; if not, we’ll let you know.

Other Liable Parties: Sometimes, there may be another party we can pursue. For example, if the at-fault driver was on the job for an employer at the time of the crash (delivering something, driving a company car, etc.), the employer might be vicariously liable – and they likely have insurance or assets. Or if a defective vehicle component contributed, a product manufacturer might be liable. In drunk driving cases, Texas’s “dram shop” law might make a bar or restaurant liable if they overserved the driver who caused the crash. Our team will explore every angle to find coverage.

Hit-and-Run Cases: This is a subset of uninsured cases – if you can’t identify the driver because they fled, it’s essentially an uninsured scenario. You would use your UM coverage if you have it. It’s important to report the accident to police and try to find witnesses or camera footage in hit-and-run situations, but if the driver isn’t found, you’re limited to your own coverages. We recently had a case where a client was rear-ended on Loop 1604 by a hit-and-run driver; we helped her collect the maximum under her UM policy to cover her surgery and losses.

Bottom line: You still have options even if the other driver had no insurance. Our attorneys will guide you through making uninsured/underinsured motorist claims and make sure your own insurance treats you fairly. We’ll also see if there’s any creative way to find another source of recovery. It’s one of those situations where having an experienced lawyer is very valuable – we know the ins and outs of insurance law and will work hard to get you compensated, one way or another.

In many cases, yes – as long as you were not mostly at fault. Texas follows a modified comparative negligence rule (the 51% bar rule). This rule says you can recover compensation if you were 50% or less at fault, but your amount will be reduced by your percentage of fault. However, if you are 51% or more at fault, you cannot recover anything.

Insurance adjusters know this law and will often argue that you were partially to blame to reduce what they have to pay. They might claim you were looking at your phone, or you braked too suddenly, or you “should have seen” the other driver coming, etc. Part of our job is to push back against exaggerated blame. We gather evidence to show clearly what happened and who truly caused the crash. If it’s evident some portion of fault is on you, we’ll advise you how that might affect the case. But we fight to minimize any assigned fault. Even if you might bear a small share of blame, that doesn’t prevent you from getting compensation for the other party’s larger share of negligence.

Also, Texas law on proportionate responsibility can get complicated if multiple defendants are involved or if someone not party to the case is partially at fault. Rest assured, we have deep knowledge in this area. We will work to maximize the fault on the other side and protect your right to recovery. The key takeaway: Being partly at fault does not bar you from recovery unless you are mostly at fault. So never assume you can’t seek compensation just because you think you might be a little to blame. Let us evaluate that. You might still have a viable claim.

Be very cautious about accepting an early settlement offer from an insurance company. Insurance adjusters often reach out quickly – sometimes within days of the accident – with a settlement offer, especially if they sense you don’t have a lawyer yet. This offer might sound tempting (“fast cash” when you’re in a tough spot), but it’s commonly a lowball offer aimed to close the claim cheap before you understand the full extent of your injuries and rights. Here are some considerations:

Have you completed medical treatment or at least fully evaluated your injuries? If not, you truly don’t know what your case is worth yet. For instance, that neck pain you have could turn out to be a herniated disk needing surgery – something that a $2,000 quick settlement wouldn’t begin to cover. Once you sign a release and take a settlement, you cannot go back for more if you later discover your injuries were more serious. The insurance company settlement will require you to sign away all future claims. That’s why they want to catch you early.

Did you consider all damages (lost wages, future treatment, etc.)? Early offers often just account for immediate medical bills and a token amount for pain. They often ignore things like future physical therapy needs, lost work time, or the emotional toll. We often see people offered a few thousand dollars that wouldn’t even cover a month of their lost wages, let alone other damages.

Is liability clearly in your favor? If there’s any question of fault, the insurance might try to settle cheap under the guise that you might lose if it went to court. Don’t be intimidated – consult a lawyer to get a real perspective. We offer free consultations, so you have nothing to lose by getting our opinion on an offer.

Pressure tactics: Adjusters might say “This is the best we can do” or “This offer expires in 48 hours” or “You don’t really need an attorney; we can handle this right now.” These are pressure tactics. You have the right to take your time and consult an attorney. There is no legitimate reason an offer would “expire” so quickly other than to pressure you. If they’re offering money now, they’ll still need to fairly compensate you later – and if they don’t, a court can make them. So don’t let FOMO (fear of missing out) drive you into a poor decision.

PRO TIP: Don’t sign or accept anything without legal counsel, especially if you have any significant injuries. We can usually tell if an offer is far too low. Often, once we’re involved, the insurance company gets more serious. For example, we had a client offered $4,000 on his own; after we took the case and documented his damages, we settled for over $50,000 – because he had a herniated disc that required injections, which the early offer didn’t account for at all.

If you do consider an offer, ask yourself: does it include pain and suffering or just bills? Does it cover property damage separately? Will they pay your medical providers directly or are you responsible for those bills out of the settlement? It can be complex, and that’s where a San Antonio accident attorney comes in. We’ll break it down and negotiate further.

In short, it’s usually NOT in your best interest to take the first offer. Insurance companies are in the business of paying as little as possible. By consulting with us, you can determine a fair range for settlement based on your case specifics. We often can secure a much higher amount, even after accounting for attorney fees, than what you’d net by taking a quick low offer. And if the offer is fair (rare, but possible in clear-cut minor cases), we’ll tell you that too.

It’s quite common to not fully feel or realize an injury immediately at the scene of an accident. As mentioned earlier, adrenaline can mask pain, and some injuries have delayed symptoms (whiplash, concussions, internal injuries). If you started feeling pain or symptoms hours or days after the crash, you should still see a doctor as soon as you can. Documenting that timeline is important (for example, go to your primary care or an urgent care and explain, “I was in a car accident a few days ago, and now I’m experiencing XYZ symptoms”). Many times, the medical records will note that the patient’s complaints are related to a recent motor vehicle accident.

From a legal standpoint, delayed treatment can give insurance companies an opening to argue that you weren’t really hurt in the accident, or something else happened in between. We counter that by explaining the medical reality of delayed-onset injuries. Still, the sooner you seek evaluation once you notice an issue, the better for your health and your case. Don’t “tough it out” thinking pain will just go away. Get checked out.

Even if you told officers at the scene “I’m okay” but later had issues, that doesn’t bar you from making a claim. It’s understandable – many people decline EMS at the scene only to go to the ER that night when the pain sets in. Insurers will scrutinize gaps in treatment, but as long as the gap is reasonably explained, you can still claim those injuries. We’ve successfully handled many cases with a delayed medical start.

The key is: be truthful and consistent about when symptoms arose. If you felt fine until the next morning when you woke up sore, say that. That’s entirely believable and common. Our job will be to connect the dots with medical expert opinions if needed (for instance, a doctor stating that the kind of injury you have often has delayed onset).

So, don’t be discouraged if you didn’t go to the ER right away. Just get care when you realize you need it, and then consult a lawyer to protect your rights. The worst thing would be to ignore a potential injury and then have it worsen. It’s both a health risk and a risk to your claim because longer delays make the causal link hazier. When in doubt, get medical help. Your well-being comes first, and documentation will follow from that.

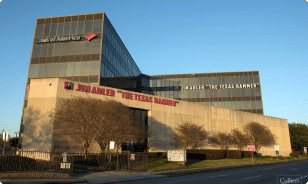

Jim Adler & Associates – The Texas Hammer® – is ready to fight for you.

We have a San Antonio office ready to serve clients in Bexar County and surrounding areas. Our team can respond quickly, investigate your case, and deal with the insurance companies and paperwork while you focus on recovering. We’ve helped countless Texans living in San Antonio recover compensation for medical bills, lost wages, and pain and suffering. Let us put our experience to work for you.

Contact us now for a FREE, no-obligation consultation.

Our San Antonio office is conveniently located at 7330 San Pedro Ave, Suite 700, San Antonio, TX 78216 (in the North Star area), but if you can’t come to us, we’ll come to you – at home or even in the hospital. We also have a full Spanish-language website (ElMartilloTejano.com) for our Spanish-speaking clients.

Time is of the essence. Every day you wait, the insurance company is working to protect their interests – not yours. Don’t give them a head start. Put The Texas Hammer® in your corner and level the playing field. We will aggressively pursue the maximum compensation for you and get you justice, whether through a negotiated settlement or a jury verdict. And we’ll keep you informed every step of the way.

“After being involved in a car accident, I was faced with the challenge of determining who to contact for guidance. Deciding to reach out to Jim Adler’s office was one of the best decisions I made after my car accident. It is apparent that they have considerable experience in handling cases similar to mine. They instilled hope in me and gave me confidence that everything will be okay, the team maintains regular communication with me and always ask about my well being! Their efficiency and responsiveness are commendable. I am thankful for all there hard work & effort.”

– Ashley Cerros

Hurt in an accident? Tell us what happened. We’ll give you straight answers — fast, free, and with no strings attached.*

Address

2711 North Haskell Ave.

Suite 2500

Dallas, TX 75204

Address

1900 W Loop S

20th Floor

Houston, TX 77027

Address

12605 East Freeway

Suite 400

Houston, Texas 77015

Address

7330 San Pedro Ave

Suite 700

San Antonio, TX 78216