Who’s Liable, What You’re Owed, and How to Get Paid

Rideshare services like Uber and Lyft have made getting around Texas easier than ever. But when an accident happens — whether you were a passenger, another driver, or even a pedestrian — the situation gets legally complicated.

Whose insurance pays? Can you sue Uber directly? What if the driver wasn’t even logged in? These questions matter — and the wrong move could cost you the compensation you deserve.

Here’s what you need to know, and how our Texas Uber and Lyft accident lawyers can help.

What Causes Rideshare Accidents in Texas?

Uber and Lyft drivers aren’t professionals. Many are part-time workers juggling multiple gigs, racing the clock to complete as many rides as possible. The result? Risky behavior.

Common causes of rideshare crashes include:

- Distracted driving – checking the app, using GPS, or texting passengers

- Speeding to finish trips faster

- Sudden stops in unsafe locations to pick up/drop off riders

- Fatigue from long shifts or working late hours

- Poor familiarity with local roads or traffic laws

- Driving under the influence

Houston, Dallas, and Austin are especially prone to Uber and Lyft crashes due to high traffic density and heavy rideshare usage.

Who’s Liable in an Uber or Lyft Accident?

Liability depends on what the rideshare driver was doing at the moment of the crash — and Texas law treats this very differently depending on their status in the app.

Driver Is NOT Logged into the App

The driver is considered off-duty. Their personal auto insurance is responsible. Uber and Lyft provide no coverage in this scenario.

Driver Is Logged In, But Waiting for a Ride Request

Texas law requires Uber and Lyft to provide contingent liability coverage:

- $50,000 per person for bodily injury

- $100,000 per accident total for injuries

- $25,000 for property damage

This kicks in only if the driver’s personal insurance denies or doesn’t cover the claim.

Driver Has Accepted a Ride or Is Transporting a Passenger

Uber and Lyft now provide their $1 million commercial insurance policy, which includes:

- Up to $1 million in third-party liability

- Uninsured/underinsured motorist coverage

- Contingent comprehensive and collision (if the driver has this on their personal policy)

This is the highest level of protection — but it often takes a lawyer to trigger it properly and ensure you’re paid fairly.

Who Can File a Rideshare Injury Claim?

You may have a valid case if you were:

- A passenger in an Uber or Lyft

- The driver or passenger of another vehicle hit by a rideshare car

- A pedestrian, cyclist, or motorcyclist injured by a rideshare driver

Each scenario has a different liability path, but all should start with legal guidance before speaking to insurance adjusters.

Real-Life Example

Maria’s Story:

Maria, a schoolteacher in Dallas, was riding in a Lyft when her driver ran a red light and was hit by another car. She suffered a fractured wrist and severe whiplash. The driver’s app was active, which triggered Lyft’s $1 million policy — but their insurance team delayed payout for months, claiming “contributory fault.”

With a lawyer’s help, Maria proved she was an innocent passenger and recovered over $220,000 — enough to cover surgery, lost wages, and rehab.

What Compensation Can You Recover?

Texas law allows accident victims to recover both economic and non-economic damages.

You may be eligible for:

- Emergency care, hospitalization, and follow-up treatment

- Physical therapy, rehab, and future medical needs

- Lost income and reduced earning capacity

- Pain and suffering (physical and emotional)

- Permanent disability or disfigurement

- Property damage (to your car, bike, etc.)

- Punitive damages (if the driver was grossly negligent)

How the Rideshare Accident Claim Process Works

- Gather evidence at the scene – including driver details, witness info, and app screenshots.

- Report the crash to police and seek medical care.

- File a claim – either with Uber/Lyft’s insurer or your own (in some cases).

- Begin negotiations – most victims receive lowball offers or face stall tactics.

- File a lawsuit if needed – this may be necessary in high-damage or denied cases.

Tip: Always request the driver’s accident report and a record of their app activity at the time of the crash. These details are often essential for proving coverage.

Passenger Rights vs. Driver Rights

- Passengers are typically fully covered under Uber/Lyft’s $1 million policy during an active trip.

- Rideshare drivers, however, must often fight to prove they were on the app — especially if their phone crashed or they weren’t actively engaged in a ride.

This gray area is where most rideshare accident disputes arise — and why having a lawyer matters.

Insurance Tactics to Watch Out For

Uber and Lyft don’t want to pay. Their insurers may try to:

- Downplay your injuries

- Claim the driver wasn’t logged in

- Argue multiple policies don’t apply

- Delay, ignore, or reject your claim

- Offer quick cash settlements far below your actual damages

They’re betting you’ll take the first offer — or never call a lawyer.

Why Uber and Lyft Claims Are Tougher Than Regular Accidents

If you’ve been in a regular car crash, you typically deal with one driver and one insurance company. But in a rideshare accident, it’s common to deal with:

- The driver’s personal insurance

- Uber or Lyft’s corporate insurance

- Your own insurance (if you’re underinsured)

- Possibly a third-party driver if more than two vehicles were involved

That’s three or more insurers, all trying to avoid responsibility. The paperwork, delays, and blame-shifting can feel impossible to deal with — unless you have someone on your side who’s done it before.

How Long Do Uber/Lyft Accident Cases Take?

Rideshare cases often take longer than standard car accident claims. That’s because:

- Liability can be disputed between multiple insurers

- Uber/Lyft may delay confirming the driver’s status in their app

- You shouldn’t settle until you finish medical treatment (or reach maximum improvement)

- If the case goes to court, expect 12–24 months before resolution

We’ll give you a realistic timeline based on your injuries and who’s involved — and we’ll handle every step so you can focus on healing.

We Help with More Than Just Money

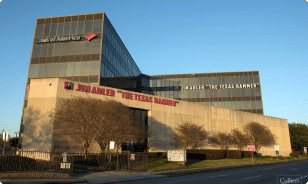

At Jim Adler & Associates, we’re not just here to get you a check (though we’re great at that, too).

We also help:

- Connect you with doctors who specialize in accident injuries

- Work with your providers to delay billing until your case settles

- Protect you from debt collectors, aggressive insurers, and stressful paperwork

- Explain what to expect at every step so you’re never left in the dark

Texas Rideshare Laws You Should Know

Texas defines Uber and Lyft as Transportation Network Companies (TNCs) and regulates them under Chapter 2402 of the Texas Occupations Code.

Key points:

- Drivers must carry liability insurance (personal or via Uber/Lyft)

- Companies aren’t automatically liable unless gross negligence is proven

- You cannot sue Uber or Lyft directly in most crashes — but you can file against their insurer

Frequently Asked Questions

Q: Can I sue Uber or Lyft directly?

A: In most cases, no. Their drivers are classified as independent contractors, not employees. However, if Uber or Lyft failed to properly screen a dangerous driver, you may have grounds to sue them for negligence.

Q: What if the rideshare driver wasn’t at fault?

A: You can still file a claim against the other driver’s insurance — and possibly use the rideshare policy’s underinsured coverage if needed.

Q: Can pedestrians or cyclists file a claim?

A: Absolutely. If a rideshare driver hit you while using the app, you may be covered under their commercial policy.

Related Articles You May Like

- How Car Accident Claims Work in Texas

- Rear-End Collision Lawyer in Texas

- DUI and DWI Accidents in Texas

- Uninsured Motorist Accidents in Texas

Get Your Free Rideshare Crash Case Review

If you’ve been hurt in an Uber or Lyft accident, don’t try to fight the insurance companies alone. They have lawyers. So should you.

Call Jim Adler & Associates now at 1-800-505-1414 or click here to request your free case review online