Insurance companies like to show how friendly and helpful they are in car insurance ads on TV. But don’t be fooled. After a car wreck, you must be wary of dealing with insurance adjusters whose jobs depend on giving you the lowest settlement possible.

An Adjuster Is Not Your Friend

Friendly? Hardly. The adjuster is not your friend. The adjuster’s job is to make money for his or her employer (the insurance company) by minimizing what you’re paid for your claim. That may mean offering you a quick “low ball” settlement far below the money to which you’re entitled. Never accept such an offer, which also will prevent you from claiming anything else.

Also keep in mind that the adjuster for your claim probably doesn’t work for your own insurance company. Most injury claims are made against the insurance company of the driver who was at fault. If a bad driver harmed you or a loved one, your claim will be made to that driver’s insurer.

An exception would be if the bad driver lacks auto liability insurance, even though it’s required by Texas law. Then, if you’ve purchased uninsured motorists coverage for your own insurance policy, you can make an injury claim to your own insurance company.

But even in such cases, you’ll be dealing with insurance adjusters whose job is to deny, delay and underpay you for your claim. They may act friendly, but they want the worst for you, and the best for their employer.

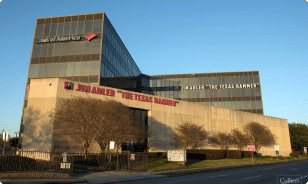

“The job of the adjuster is to minimize your injuries and even make you feel guilty and at fault for bringing a claim,” says Jim Adler. “Most people who have a wreck that wasn’t their fault still feel a bit guilty, and the adjuster preys on that.”

Don’t Make Statements to Adjusters

Such tactics are why you must know how to deal with adjusters after a car wreck — and that starts with not making any recorded statements which later can be used against you. In fact, it’s best not to give adjusters any information beyond basic facts without first consulting an experienced car wreck lawyer or injury attorney with Jim Adler & Associates.

When an adjuster first calls you to go over your claim, you are not required to make a statement — no matter what the adjuster says. Simply direct the adjuster to your auto accident lawyer. He or she will recognize the pitfalls and guard you against them.

Injury Attorneys Knows Adjusters’ Tricks

Indeed, our car accident lawyers have years of experience dealing with insurance adjusters every work day. They know adjusters’ tricks of the trade. They know what you should and shouldn’t say to an adjuster and how to protect your legal rights for a full settlement after a bad driver injured you.

That starts with knowledge of how much your injury is worth. Based on the experience of dealing with thousands of cases, your auto accident attorney knows the reasonable and fair amount insurance companies should pay for various injuries.

Such amounts take into account the nature of an injury, hospital and medical bills for treatment, any lost wages due to the injury and the victim’s pain and suffering.

An Adler car wreck attorney can negotiate with adjusters to get you the best settlement possible. Most car accident cases are settled in this way. But if the insurer balks and still won’t pay, we can file a car accident lawsuit in your behalf to gain what you deserve.

Get a Free Case Review Today

Don’t handle your car accident claim alone. Contact our law firm today for a free legal review of your case. Unlike adjusters, we have your best interests at heart, and will help you explore the best route to a successful settlement for you and your family.