When you’re involved in a car accident, the physical injuries are just the beginning. The real stress often starts when you file your insurance claim—and run headfirst into a wall of delay tactics, confusing policy language, and lowball offers.

Insurance companies are billion-dollar businesses. Their goal? Protect their bottom line—not you.

And unless you know how the system works, it’s easy to walk away with far less than you deserve.

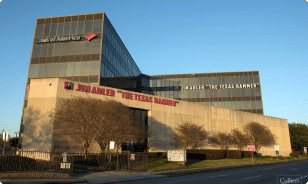

At Jim Adler & Associates, we’ve been hammering insurance companies across Texas for over 50 years. In this guide, we’ll break down how the auto insurance claims process works in Texas, the tricks insurers use to limit payouts, and how hiring an experienced attorney can protect your rights and maximize your compensation.

The Claim Process, Step by Step

Step 1: Gather Your Evidence—Immediately

Before you even pick up the phone to call your insurance company, start documenting everything related to your accident:

- Photos and videos of the scene, damages, skid marks, traffic signs, and injuries

- Contact and insurance info from all drivers involved

- Witness names and phone numbers

- A copy of the police accident report

- Proof of medical treatment (bills, diagnosis, prescriptions)

- Estimates for vehicle repair

🛑 Tip: Create a digital folder to store all this information. Screenshots, emails, receipts—if it’s not documented, it didn’t happen.

Step 2: Communicate Smart

Once your claim is opened, keep your communication organized and strategic.

- Log every phone call: who you spoke with, the date, and what was said.

- Get everything in writing. Verbal promises mean nothing.

- Save all voicemails, emails, and letters.

- Never admit fault or speculate. Let the evidence—and your lawyer—do the talking.

And most importantly: stay off social media. Even innocent posts can be twisted by the insurance company to reduce or deny your claim.

Step 3: Watch for Delays and Denials

Texas law requires insurance companies to:

- Acknowledge your claim within 15 calendar days

- Investigate and make a decision within 15 business days of receiving all documentation

- Provide a reason in writing if they deny your claim

- Pay within 5 business days of accepting the claim

But that doesn’t mean they’ll play fair. Many try to delay the process, hoping you’ll give up or accept a lowball settlement just to move on.

If your claim drags out, or if you’re being ignored or pressured to settle too soon, call a lawyer immediately.

The Games Insurance Companies Play

Insurance adjusters are trained negotiators—and their job is to save their company money. Here are a few of the tactics they use:

- Lowball first offers: They’ll offer just enough to tempt you—but far less than your case is worth.

- Blame-shifting: They may claim you were partially at fault to reduce your payout under Texas’s comparative negligence rules.

- Surveillance and social snooping: Posting vacation photos while you’re supposedly injured? They’ll use that to challenge your claim.

- Disputing medical treatment: They’ll say your injuries were “pre-existing” or that your treatment wasn’t necessary.

- Pressure to settle early: Once you accept a settlement, your case is closed—even if you discover more injuries later.

They hope you don’t know your rights. That’s why having a tough legal team matters.

How a Lawyer Can Strengthen Your Claim

Here’s how we at Jim Adler & Associates step in to protect you:

1. Independent Investigation

We don’t rely on the insurance company’s version of the story. We gather additional evidence—like traffic camera footage, 911 calls, vehicle black box data, and expert analysis.

2. Medical Review and Case Building

We consult with doctors, accident reconstruction experts, and economists to fully understand your injuries, treatment needs, and long-term costs. This becomes critical evidence to support a strong demand.

3. Identifying All Coverage

You may be entitled to compensation from:

- The other driver’s policy

- Your own uninsured/underinsured motorist coverage

- Personal injury protection (PIP)

- Medical payments (MedPay)

- Umbrella policies or commercial policies

We leave no stone unturned.

4. Fighting for Maximum Compensation

Whether through aggressive negotiation or a lawsuit, we don’t stop until you get the compensation you deserve—for:

- Medical bills

- Future treatment

- Lost wages

- Pain and suffering

- Property damage

- Wrongful death (in fatal crashes)

Common Mistakes That Hurt Your Claim

Even innocent missteps can damage your case. Here’s what to avoid:

- Talking too much to the adjuster: They’re trained to get you to say something they can use against you.

- Delaying medical treatment: Insurers use gaps in care to claim your injuries weren’t serious.

- Signing anything without review: You could waive rights or agree to a low settlement.

- Posting online about your accident: It could be twisted to dispute your injuries.

- Failing to call a lawyer early: The sooner you get legal representation, the better your outcome.

How Long Do Insurance Companies Have to Respond in Texas?

By Texas law:

- Insurers have 15 days to acknowledge your claim.

- Once you submit all documentation, they have 15 business days to approve or deny it (or 45 if they have a valid reason).

- If they approve your claim, they must pay you within 5 business days.

If they violate these deadlines, they may owe you interest, attorney’s fees, and penalties. We hold them accountable.

Frequently Asked Questions

How long does a car insurance claim take in Texas?

It varies. Simple property damage claims may resolve in weeks. Injury claims—especially those involving treatment or litigation—can take months. Insurers have legal deadlines but often try to delay. A lawyer speeds things up and keeps them honest.

What if the other driver doesn’t have insurance?

If you have uninsured/underinsured motorist (UM/UIM) coverage, your own policy may pay out. We’ll review your policy and file claims to make sure no benefit is left behind.

Do I need a lawyer if the insurer already made an offer?

Absolutely. That first offer is usually low. We routinely recover 2–5x more than what the insurer first offered our clients. Don’t leave money on the table.

Will I have to go to court?

Most claims settle out of court. But if the insurance company won’t budge, we’re fully prepared to take them to trial—and win.

What does it cost to hire Jim Adler & Associates?

We work on a contingency fee. That means you pay nothing up front—and we only get paid if we win. If you don’t get paid, we don’t get paid.

Why Texans Trust Jim Adler & Associates

- ✅ 50+ years of experience hammering insurance companies

- ✅ Offices in Houston, Dallas, San Antonio, and across Texas

- ✅ Hundreds of millions recovered for crash victims

- ✅ You don’t pay unless we win your case

We’ve handled every kind of car crash—rear-end, head-on, rollover, 18-wheeler—and we know how to beat the insurance playbook.

Don’t Face the Insurance Company Alone

You’re not just another claim number. You’ve been hurt. Your vehicle is damaged. You’re facing bills, pain, and lost time. You deserve a team that fights like family.

Whether your crash happened in Houston, Dallas, San Antonio—or anywhere in Texas—our attorneys are ready to help.

Call Jim Adler today for a FREE consultation.