One moment you were heading home after a long day, and the next you were surrounded by sirens and strangers asking if you were okay. A rideshare trip that should have been routine turned into something that changed everything. Now you are hurt, confused, and facing billion-dollar companies that have teams of lawyers ready to fight against you.

Uber and Lyft did not build their insurance systems to help you after an accident. They built them to create confusion and avoid paying what they owe. Their adjusters will contact you quickly, sound concerned, and ask questions that seem harmless. Everything you say gets recorded and analyzed for ways to reduce your claim or deny it entirely.

These companies know that most people have never dealt with anything like this before. They count on you not understanding how their tiered insurance works or which policy applies to your situation. They count on you accepting whatever they offer because you are overwhelmed and need money for medical bills. That confusion is not an accident. It is their strategy.

Research shows that injured victims with legal representation receive settlements substantially higher than those who negotiate alone.[1] You are not facing a fair fight, and you should not have to figure this out on your own while you are trying to heal.

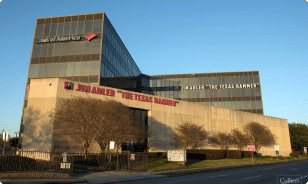

Jim Adler & Associates, The Texas Hammer®, has taken on these corporate giants before and knows exactly how they operate. We step in from day one to handle their legal teams, cut through the insurance confusion, and secure the evidence that proves what your case is really worth. When Uber, Lyft, and their insurers try to avoid responsibility, we are ready to fight back.

You are not dealing with a simple car accident claim where one driver hit another, and one insurance company pays. Rideshare accidents throw you into a maze of overlapping policies, corporate legal teams, and finger-pointing that never seems to end. Everyone involved has a reason to blame someone else, and you are stuck in the middle trying to figure out who actually owes you compensation. Jim Adler & Associates takes over that fight so you can focus on getting better.

Rideshare insurance is complicated on purpose, and nobody is going to explain it to you unless they are paid to fight for you. Depending on what the driver was doing at the exact moment of the accident, three different insurance policies might apply to your situation. The driver’s personal policy might cover you, or the rideshare company’s policy might kick in, or you might need to rely on your own insurance to get any compensation at all.

Uber and Lyft spent millions of dollars designing a business model that helps them avoid responsibility when accidents happen. They call their drivers independent contractors instead of employees. They claim to be nothing more than a technology platform that connects riders with drivers. They insist they do not control the vehicles or how drivers operate them. Every piece of this structure exists to give them an argument against paying your claim.

When multiple parties share fault for your accident, the confusion multiplies. The rideshare driver may have caused the accident, but another motorist might have contributed. The company itself might bear responsibility for putting a dangerous driver on the road. Vehicle manufacturers and government entities responsible for road conditions could also share liability.

You only need one team fighting on your side, and Jim Adler, The Texas Hammer®, cuts through all the finger-pointing to hold every responsible party accountable.

The people handling your rideshare claim are not regular insurance adjusters. They are specialists trained specifically to protect corporate defendants from claims like yours. They know that most victims do not understand how tiered coverage systems work, and they use that confusion to offer as little as possible.

These adjusters have a playbook they follow in almost every case. They will claim the driver was not logged into the app at the time of your accident. They will argue that the driver’s personal insurance should pay instead of the corporate policy. They will point to policy exclusions you have never heard of and could not have known about. They will dispute whether the driver was approaching a pickup or actively transporting a passenger, because those two situations trigger different coverage amounts. Every single argument is designed to reduce what they pay you or deny your claim entirely.

The evidence that proves what really happened in your accident could vanish within hours or days. App data showing exactly what the driver was doing gets altered or deleted from company servers. Dash-cam footage that might show the accident overwrites automatically as drivers continue working. Logs that reveal how long the driver had been on the road disappear. Route information that might prove the driver was speeding to reach a pickup vanishes from the system. Communications between you and the driver about unsafe conditions get erased.

The companies control all of this data, and they will not share it with you voluntarily. They hide behind claims of privacy concerns and proprietary information. They do everything possible to keep evidence out of your hands when that evidence might prove their liability. Jim Adler, The Texas Hammer®, knows how to force disclosure through legal action before this critical evidence disappears forever.

Jim Adler & Associates works on a contingency basis, which means you pay no attorney fees unless we recover compensation for you.* If your case settles without a lawsuit, our fee is 35% of the recovery. If we need to file a lawsuit to fight for fair compensation, the fee is 40% of the recovery. We advance all case expenses, so you never have to pay anything out of pocket while your case is ongoing.

This arrangement levels the playing field against billion-dollar corporations that have nearly unlimited legal budgets. They cannot outspend you when Jim Adler, The Texas Hammer®, is fighting on your side. You focus on healing from your injuries while we focus on winning your case.

With hundreds of rideshare accident lawsuits filed, our numbers speak for themselves.

Client Received

$15, 461, 000

Attorney Fees

$10, 398, 984 .43

Expenses

$140, 015 .57

Client Received

$15, 461, 000

Attorney Fees

$10, 398, 984 .43

Expenses

$140, 015 .57

Client Received

$9, 436, 300

Attorney Fees

$6, 399, 965

Expenses

$163, 735

Client Received

$9, 436, 300

Attorney Fees

$6, 399, 965

Expenses

$163, 735

Client Received

$4, 898, 086

Attorney Fees

$3, 806, 000

Expenses

$227, 835

Client Received

$4, 898, 086

Attorney Fees

$3, 806, 000

Expenses

$227, 835

Client Received

$3, 237, 600

Attorney Fees

$2, 199, 623 .77

Expenses

$62, 776 .23

Client Received

$3, 237, 600

Attorney Fees

$2, 199, 623 .77

Expenses

$62, 776 .23

The growth of rideshare services in Houston has come with serious consequences for passenger safety. According to a study reported in Science, ridesharing correlates with a 2% to 3% increase in traffic fatalities involving car occupants and pedestrians, with the highest increases concentrated in large cities like Houston.[2] As more rideshare vehicles fill Houston streets, accidents become more common. Many drivers work part-time and lack the experience of professional transportation operators. The constant pressure to check apps and respond to ride requests creates dangerous distractions behind the wheel.

Research published in the American Journal of Epidemiology shows that rideshare drivers spend significant time cruising and searching for passengers, which increases their exposure to potential accidents.[3] Drivers staring at their phones while hunting for the next fare create real danger for everyone in their vehicle and on the road around them. Surge pricing adds even more pressure by rewarding drivers who rush to high-demand areas as quickly as possible. None of this is your fault, but you are the one who pays the price when an accident happens.

When you get into an Uber or Lyft, you trust that the driver will get you where you need to go safely. You should not have to worry about whether they are too tired to drive, whether their brakes are going to fail, or whether they are paying more attention to their phone than the road. Unfortunately, the way these companies operate creates exactly those dangers, and passengers like you pay the price when something goes wrong.

The rideshare business model turns every driver’s phone into a constant source of distraction. Notifications demand immediate attention with messages about new ride requests that will disappear if not accepted within seconds. The app requires drivers to navigate to unfamiliar pickup locations while simultaneously managing passenger ratings and tracking their earnings for the day. This is not a design flaw that Uber and Lyft overlooked. This is how they built the system to work.

When an accident happens because a driver was looking at their phone instead of the road, these companies claim they have no control over driver behavior. That argument falls apart when you consider that they designed the very system pulling the driver’s attention away from safety. Jim Adler & Associates knows how to prove that these app designs encourage dangerous behavior and hold companies accountable for the predictable consequences of their choices.

Rideshare drivers do not earn a salary or receive benefits, so the only way to make more money is to stay on the road longer. Many drivers work exhausting hours because that is what it takes to earn a decent living in the gig economy. According to Harvard Medical School, drowsy driving impairs judgment and reaction time in ways that are similar to driving under the influence of alcohol.[4]

A fatigued driver may not realize how impaired they actually are until it is too late. They react slowly to sudden stops in traffic, drift out of their lane without noticing, and make poor decisions at intersections that a well-rested driver would never make. When one of these exhausted drivers causes an accident, Uber and Lyft are quick to say they have no control over how many hours their drivers work. They take no responsibility for creating the financial pressure that pushes drivers to stay on the road long past the point of safety.

Taxi drivers and commercial transportation operators must meet strict licensing requirements and complete professional training before they can carry passengers. Rideshare companies decided those standards were too inconvenient for their business model. Anyone with a regular license, a background check, and a car that meets basic requirements can start picking up passengers with no training whatsoever.

These companies could require defensive driving courses before approving new drivers. They could test driving skills and mandate ongoing safety education. They choose not to because higher standards would cost money and shrink the pool of available drivers. The result is a system where inexperienced drivers learn on the job with paying passengers in their back seats. When those undertrained drivers cause accidents, passengers are the ones who suffer the consequences.

Personal vehicles were never designed to handle the demands of full-time commercial use. A car that might last for years under normal driving conditions breaks down much faster when it spends ten hours a day on Houston streets picking up passengers. Many drivers cannot afford to keep up with the maintenance schedule their vehicles actually need, and the companies do nothing to verify that the cars on their platform are safe.

Anyone who has driven in Houston knows how demanding these roads can be on vehicles, even under normal circumstances. A rideshare vehicle with worn brakes and bald tires is an accident waiting to happen on streets full of potholes, construction zones, and unpredictable traffic. Jim Adler, The Texas Hammer®, investigates maintenance records to find out whether neglected repairs contributed to your accident and whether the company or driver knew about dangerous conditions before you ever got in that car.

Sometimes the rideshare driver does everything right, and an accident still happens because someone else on the road acted recklessly. A drunk driver running a red light or a speeding motorist who loses control can cause a devastating collision that leaves you seriously injured through no fault of your own. These situations create complicated insurance battles where multiple companies point fingers at each other instead of paying what they owe.

Insurance companies benefit from this confusion because it gives them an excuse to delay your claim indefinitely. They argue about which policy should pay first while your medical bills pile up and your savings disappear. Jim Adler, The Texas Hammer®, cuts through this chaos by identifying every party that shares responsibility for your injuries and pursuing every available source of compensation. You should not have to wait for insurance companies to finish blaming each other before you get the help you need.

Rideshare accidents can hurt passengers, drivers, pedestrians, and people in other vehicles, and each situation creates its own set of challenges when it comes to getting fair compensation. No matter how you were injured, Jim Adler & Associates can help you understand your options and fight for what you deserve.

You got into that car trusting that the driver would get you to your destination safely. You buckled your seatbelt and assumed that a company as big as Uber or Lyft would not let dangerous drivers on the road. When the accident happened, you had no control over anything and no way to protect yourself from the impact.

Passengers should have the strongest claims of anyone involved in a rideshare accident because they bear no responsibility for what happened. You were simply a paying customer who relied on professional transportation to get you where you needed to go. Despite this, these companies still fight to pay you as little as possible. Their adjusters will question whether you were wearing your seatbelt correctly. They will dispute how serious your injuries really are and dig through your medical history looking for pre-existing conditions they can blame. They will do everything they can to minimize what they owe you.

If you were driving for Uber or Lyft when an accident happened, you face a uniquely difficult situation. The independent contractor classification that these companies fought so hard to maintain means you have none of the protections that regular employees receive. There is no workers’ compensation coverage to pay your medical bills while you recover. Your personal auto insurance may deny your claim entirely because most policies exclude coverage for commercial driving activity.

The companies that profit from your labor every single day are often the first to abandon you when something goes wrong. They built a system that avoids responsibility for the people who make their business possible. Jim Adler & Associates believes that drivers deserve better than to be left with nothing after an accident. We fight to navigate the coverage gaps these companies created and pursue every available policy that might apply to your situation.

You do not have to be a rideshare passenger to be seriously hurt by a rideshare driver. Other motorists struck by Uber and Lyft vehicles face confusing insurance battles they never asked to be part of. Pedestrians crossing the street can suffer catastrophic injuries when a distracted rideshare driver fails to stop in time.

If you were hurt by a rideshare driver, you need to know which insurance policy covers your damages. The answer depends entirely on what the driver was doing at the exact moment of impact. These companies guard that information closely and hide behind claims of privacy concerns when victims ask basic questions about coverage. They force injured people to fight for simple facts like whether the driver was logged into the app or actively transporting a passenger. Each status triggers a different level of coverage, and without this information, you cannot pursue the compensation you deserve. Jim Adler, The Texas Hammer®, knows how to force these companies to disclose what they would rather keep hidden.

The injuries from a rideshare accident can range from painful but temporary to life-altering and permanent. Some injuries make themselves known immediately at the scene, while others take hours or even days to reveal themselves. Understanding the types of injuries that commonly result from these accidents helps you recognize warning signs and document everything you need to pursue fair compensation. Jim Adler, The Texas Hammer®, works with medical experts to prove the full extent of harm you have suffered.

Rideshare accident victims commonly experience the following types of injuries:

If you have been hurt in a rideshare accident, Jim Adler, The Voice of The Victims™, can help you prioritize your recovery without the burden of immediate medical expenses. We connect injured clients with medical providers who accept a Letter of Protection, which means your medical bills are not paid until your case is successfully settled. This arrangement allows you to get the care you need right now while focusing entirely on healing.

[1] Insurance Research Council. (1999). Paying for auto injuries: A consumer panel survey of auto accident victims. Insurance Research Council.

[2] Texas Insurance Code, Chapter 1954. Insurance for Transportation Network Company Drivers. https://statutes.capitol.texas.gov/Docs/IN/htm/IN.1954.htm

The moments after a rideshare accident are chaotic and disorienting, and you are probably in pain while trying to process what just happened. Rideshare companies and their insurers know how to exploit this confusion to build a case against you. One wrong word or one missed step can become evidence they use to deny or reduce your claim. While every accident is different, understanding what typically happens next can help you feel more prepared during an incredibly stressful time.

The following steps may help protect your rights after a rideshare accident:

If you have been involved in a rideshare accident, call Jim Adler & Associates as soon as possible for a free consultation. We secure evidence before it vanishes from company servers, handle communications with corporate legal teams, and protect your rights while you focus on healing. You pay no fee unless we win your case.*

The amount of insurance coverage available after a rideshare accident depends entirely on what the driver was doing at the exact moment of impact. There are three distinct coverage periods, and each one triggers a different level of protection for injured victims.

When the driver has the app turned off completely, only their personal auto insurance applies to any accident they cause. This creates a dangerous gap because most personal auto policies specifically exclude coverage for commercial driving activity. If an off-duty rideshare driver hits you, their insurance company might deny your claim entirely and leave you with nothing.

When the driver has the app on but has not yet matched with a passenger, limited coverage kicks in under Texas Insurance Code Section 1954.052.[5] During this period, the rideshare company must provide $50,000 per person for bodily injury, up to $100,000 total per accident, and $25,000 for property damage. These amounts might sound reasonable until you realize that a single emergency room visit for serious injuries can easily exceed these limits.

Once a driver accepts a ride request or has a passenger in the vehicle, the coverage increases significantly under Texas Insurance Code Section 1954.053.[5] At this point, the rideshare company must provide a $1 million aggregate liability policy along with uninsured and underinsured motorist protection. This sounds like adequate protection for passengers until you see how aggressively these companies fight about timing. They dispute whether the driver was still approaching the pickup location or had officially begun the ride. They argue about whether the trip ended when you stepped out of the vehicle or when the app registered completion. Seconds can determine whether you have access to a million dollars in coverage or almost nothing at all.

Jim Adler, The Texas Hammer®, cuts through these games and forces companies to honor their coverage obligations to injured passengers and other victims.

Texas follows a modified comparative negligence rule that insurance companies use as a weapon against injured victims. If you share any fault for the accident, your compensation gets reduced by your percentage of responsibility. If a jury or adjuster determines you were more than 50% at fault, you may receive nothing at all, regardless of how serious your injuries are.

Rideshare insurance companies know exactly how this rule works and try to manufacture fault where none actually exists. They might claim you distracted the driver by talking to them during the ride. They might argue you failed to wear your seatbelt properly or should have warned the driver about some hazard you supposedly saw. Every percentage point of fault they can pin on you means thousands of dollars they do not have to pay. The difference between being found 20% at fault and 30% at fault on a serious injury claim can cost you tens of thousands of dollars in compensation.

Rideshare accidents often involve more than just one negligent driver. The rideshare driver may have caused the accident, but another motorist might have contributed by running a red light or failing to yield. The rideshare company itself might bear responsibility for putting a dangerous driver on the road in the first place. Vehicle manufacturers could be liable if a defect contributed to the accident. Government entities might share fault if dangerous road conditions played a role.

Each of these parties has its own insurance company and its own lawyers working to shift blame onto everyone else. This finger-pointing serves their interests by delaying your compensation while you struggle to pay medical bills and cover lost wages. Jim Adler & Associates identifies every party that shares liability for your injuries and pursues maximum recovery from all responsible sources, so you do not have to wait for insurance companies to stop blaming each other.

You have two years from the date of your accident to file a lawsuit, and that deadline is absolute in most situations. Rideshare companies and their insurers know about this deadline and sometimes deliberately delay the claims process to run out the clock. They request endless documentation, dispute coverage determinations, and drag out negotiations while time keeps passing.

Jim Adler, The Texas Hammer®, protects your case deadlines from day one, so you never have to worry about losing your rights while focused on recovery. We track every deadline, respond to delay tactics appropriately, and make sure the insurance companies cannot use time as a weapon against you.

Insurance adjusters do not sit down and carefully consider what your injuries have cost you. They enter limited information into insurance adjuster computer programs specifically designed to calculate the lowest offer they can defend. Without aggressive representation fighting back against these algorithms, that lowball number could be all you ever receive for everything this accident has taken from you. Jim Adler & Associates knows exactly how these programs work and how to counter them with evidence they cannot ignore.

The financial toll of a serious rideshare accident often shocks people who have never dealt with anything like this before. Your medical treatment alone can add up to staggering amounts that most people could never pay out of pocket. A single emergency room visit after a serious accident can cost thousands of dollars before you even see a specialist. Surgery pushes that number into tens of thousands, and long-term rehabilitation can reach six figures over time. If your injuries require ongoing care for the rest of your life, the total cost can climb into millions of dollars.

Your lost income starts adding up from the day of the accident and continues throughout your recovery. The paychecks you miss while healing are just the beginning of what this accident may cost you financially. When you finally return to work, your injuries might limit what you can physically do in your job. Promotions you were working toward may slip away because you can no longer perform at the level you did before. Some people have to change careers entirely because their bodies simply cannot handle the work they used to do. The income you lose from these limitations adds up year after year for the rest of your working life.

The financial impact extends into parts of your daily life you might not have considered. Prescription medications and medical devices become ongoing expenses that strain your budget. If your injuries affect your mobility, you may need modifications to your home just to live safely. Transportation to and from medical appointments costs money, especially when you can no longer drive yourself. Many injured people need to pay for help with household tasks they used to handle on their own. Jim Adler & Associates documents every single cost this accident has caused and fights to recover all of it.

Some of the worst things this accident has taken from you cannot be calculated on a spreadsheet. The physical pain you experience every day affects your quality of life in ways that are hard to describe to someone who has not lived through it. The emotional trauma from the accident itself may haunt you long after your physical injuries begin to heal. If your injuries leave you with permanent limitations, the mental anguish of adjusting to a different life than the one you planned is very real.

You may no longer be able to enjoy activities that used to bring you happiness and meaning. Scars and disfigurement can affect your confidence and change how you feel about yourself. Injuries that limit your physical capabilities can put strain on your marriage and other important relationships. Psychological conditions like PTSD and anxiety often require their own treatment and deserve recognition as real consequences of what happened to you.

Insurance companies will argue that these losses do not exist or do not really matter because they cannot be measured in receipts and billing statements. Jim Adler, The Texas Hammer®, knows how to prove that these damages are real and fights for substantial compensation that reflects everything this accident has truly cost you.

Most rideshare accident cases involve ordinary negligence where someone made a mistake that caused harm. In cases involving extreme recklessness or intentional misconduct, you can seek punitive damages that go beyond simply compensating you for your losses. These damages exist to punish wrongdoers for especially dangerous behavior and to deter others from acting the same way in the future.

The Tough, Smart Lawyer® knows when punitive damages may apply to a rideshare accident case and fights to hold reckless parties accountable for their conduct. If someone’s outrageous behavior caused your injuries, they should face consequences that reflect the seriousness of what they did.

Our Houston rideshare accident lawyers help Texans get the financial compensation they deserve. We only get paid if you win.* And we fight to win.

The attorney you choose to handle your rideshare accident case can make a significant difference in how much compensation you ultimately receive. Not every lawyer understands the complexity of these cases or has the resources necessary to take on billion-dollar corporations. Rideshare accidents are fundamentally different from regular car accident claims, and they require specific knowledge that many attorneys simply do not have.

These cases involve multiple insurance policies that change based on app status, corporate defendants with nearly unlimited legal budgets, and complex regulations that most people have never heard of. The wrong choice of attorney could mean accepting far less compensation than your case is actually worth.

Jim Adler & Associates has been fighting for injured Texans for more than 50 years and has recovered over $1 billion for clients during that time. We have taken on corporate giants before and understand exactly how they try to avoid paying what they owe. When Uber, Lyft, and their insurance companies see Jim Adler, The Texas Hammer®, on the other side of a case, they know we will not back down until our client receives fair compensation.

“The insurance company wanted me to settle for a lot less and Jim Adler negotiated for me to get a lot more. ” Ariana

“Jim Adler took care of, literally, everything. I didn't have to do anything.” Whitney

“Man, he worked fast. From my vehicle getting fixed ... and getting paid what I deserve for the accident. ” Sergio

“Jim Adler was to me, he was the last string of hope that I had. He was my saver.” Bryan

“I called Jim Adler and he came through. They got me more than the insurance company had offered.” Tamara

“Definitely took charge of the situation from the very beginning. It was A-Z. I didn't have to do anything... I was definitely happy with the compensation.” Troy

You should not have to fight billion-dollar corporations on your own while recovering from a serious accident. Uber, Lyft, and their insurance companies have teams of lawyers and adjusters whose only job is to pay you as little as possible. They are counting on you to feel overwhelmed by their deliberately complex insurance system. They want you to accept a quick settlement offer before you understand what your case is really worth.

You deserve someone fighting just as hard for you as they are fighting against you. Jim Adler & Associates knows their tactics because we have seen them countless times before. We understand exactly how their insurance structures work and where they try to hide from responsibility. We have the resources and determination to take on these corporate giants and win.

Contact Jim Adler, The Texas Hammer®, today for a free consultation to evaluate your rideshare accident case. You pay no fee unless we recover compensation for you.*

Rideshare accidents raise complicated questions about liability, coverage, and compensation that most people have never had to think about before. Insurance companies count on your confusion about these issues to pay you less than you deserve. The answers below can help you understand your rights and protect your case as you figure out what to do next.

If you do not see your question answered here, call Jim Adler & Associates today for a free consultation.* We help Texans injured in rideshare accidents in both English and Spanish.

The moments after a rideshare accident are confusing and frightening, and you are probably hurting while trying to figure out what just happened. Calling 911 should be your first priority because police need to document the scene and create an official report. Make sure the officers know you were in a rideshare vehicle because this detail affects which insurance policies apply to your situation. That police report becomes critical evidence later when insurance companies try to claim the accident never happened or was not as serious as you say.

Even if you feel relatively fine at the scene, you should seek medical attention as soon as possible. Adrenaline masks pain in ways that can fool you into thinking you are okay when you are actually injured. What feels like minor soreness right after an accident can become unbearable pain hours or days later. Insurance companies use any delay in treatment to argue that you were not really hurt or that your injuries came from something else.

Take a screenshot of your ride information in the app before you do anything else with your phone. Capture the driver’s name, the vehicle details, your trip route, and the time stamps showing when the ride started. This information may become difficult to access later, and rideshare companies have been known to claim they cannot retrieve data that would help your case.

If you can do so safely, take photographs of everything at the scene of the accident. Document damage to all vehicles from multiple angles and capture the road conditions, including traffic signals and signs. Photograph any visible injuries on yourself or others because these images become evidence that insurance companies cannot easily dispute later.

Collect contact information from the driver, any other motorists involved, and anyone who witnessed what happened. Police reports do not always capture every detail, and witnesses sometimes leave before officers have a chance to interview them. Having independent contacts who can verify what happened strengthens your case significantly.

If you report the accident through the rideshare app, keep your statement as brief as possible. Say only that an accident occurred and that you are seeking medical attention. Do not discuss who was at fault, do not apologize for anything, and do not speculate about what caused the accident. Every word you put in that app becomes evidence that their legal teams will analyze for ways to use against you.

Insurance adjusters may contact you soon after the accident, and they will sound friendly and concerned about your well-being. Do not give them recorded statements before speaking with Jim Adler, The Texas Hammer®, because they are actually building a defense against your claim while pretending to help you.

The answer to this question depends entirely on what the driver was doing at the exact moment of impact, and rideshare companies exploit this complexity to deny claims whenever possible. Understanding which insurance applies requires knowing the driver’s app status, which is information these companies guard closely.

When the driver has the app completely turned off, only their personal auto insurance applies to any accident they cause. This creates a serious problem because most personal auto policies specifically exclude coverage for commercial driving activity. You might discover that the driver who hurt you has no valid coverage at all, despite having carried paying passengers throughout the day.

When the driver has the app turned on but has not yet matched with a passenger, limited coverage kicks in under Texas Insurance Code Section 1954.052.[5] During this period, the rideshare company provides $50,000 per person for injuries and $100,000 total per accident. These amounts might sound adequate until you realize that a single emergency room visit for serious injuries can exceed these limits before you even see a specialist.

Once a driver accepts a ride request or has a passenger in the vehicle, the million-dollar liability policy required by Texas Insurance Code Section 1954.053 should cover your damages.[5] Insurance companies fight constantly about the exact timing of when this coverage applies. They dispute whether the driver was still approaching the pickup location or had officially begun the ride. They argue about whether the trip ended when you stepped out of the vehicle or when the app registered completion. A matter of seconds can determine whether you have access to a million dollars in coverage or far less.

Your own insurance policies might also come into play depending on the circumstances of your accident. Uninsured motorist coverage protects you when the at-fault driver has no valid insurance. Underinsured motorist coverage helps when the other driver’s policy limits fall short of covering your damages. Personal injury protection and medical payments coverage can pay your medical expenses regardless of who was at fault.

Jim Adler & Associates has extensive experience untangling this deliberately confusing system. We identify every insurance policy that might apply to your situation and force disclosure of app status data that companies try to hide. We pursue maximum recovery from all available sources and refuse to let insurance companies use complexity as an excuse to underpay your legitimate claim.

Rideshare companies have spent millions of dollars on lawyers and lobbyists specifically to avoid direct liability when their drivers cause accidents. They argue that drivers are independent contractors rather than employees. They claim to be nothing more than technology platforms that connect riders with drivers. They insist they do not control the vehicles or how drivers operate them. Every single one of these arguments exists to help them avoid responsibility for accidents their business model helps cause.

These defenses are not absolute, and Jim Adler, The Texas Hammer®, investigates every possible avenue of liability without accepting the independent contractor argument at face value. We look for evidence that the company was negligent in hiring drivers who should never have been approved. We examine whether their app design and notification systems create dangerous distractions. We pursue direct claims against these corporations when the facts support holding them accountable. We force these billion-dollar companies to answer for putting their profits ahead of passenger safety.

Texas follows a modified comparative negligence rule that insurance companies use to reduce what they pay injured victims. If they can convince an adjuster or jury that you bear 30% of the fault for not wearing a seatbelt, your compensation drops by that same percentage. A case worth $100,000 becomes worth only $70,000 because of one decision you made at the start of the ride.

This defense has real limits that insurance companies do not want you to know about. They must prove that wearing a seatbelt would have actually prevented the specific injuries you suffered. Medical experts have to testify about the connection between your injuries and seatbelt use. If you have a broken leg from the impact of the collision, they cannot reasonably blame that injury on whether you were buckled up. Head trauma from hitting a window gives them a stronger argument, but even then, the connection must be proven.

Many passengers do not buckle up when riding in the back seat of a rideshare vehicle. Some people assume the back seat is safer, and others feel uncomfortable asking a stranger about seatbelt requirements. Insurance companies know this is common behavior and exploit it to minimize what they pay by claiming you failed to ensure your own safety.

Not wearing a seatbelt cannot completely prevent you from recovering compensation in most situations. Even if you share some fault for your injuries, you can still collect damages as long as your percentage of fault stays below 51% under Texas law.

Jim Adler & Associates works with medical experts who can testify about whether seatbelt use would have actually prevented or reduced your specific injuries. We fight to minimize any fault assigned to you and refuse to let insurance companies use this argument to escape paying fair compensation for accidents their drivers caused.

Hit-and-run accidents create immediate chaos and long-term insurance complications that can feel impossible to navigate on your own. The driver who caused your injuries has disappeared, leaving you without their contact information, insurance details, or any way to hold them directly accountable. Rideshare companies sometimes claim they cannot help because they do not know what happened or who was driving.

A thorough police investigation becomes absolutely critical when a rideshare driver flees the scene. Officers who respond to the accident gather evidence about the fleeing vehicle that you might not have been able to capture yourself. Witnesses may have seen the license plate or noticed distinctive features of the vehicle. Traffic cameras and security footage from nearby businesses might have recorded the incident. This investigation can identify the driver and allow your claim to move forward.

Jim Adler, The Texas Hammer®, acts immediately to secure evidence and pursue all available insurance sources when a driver flees. We do not let fleeing drivers escape responsibility for the harm they caused. We identify every possible source of recovery to ensure you receive fair compensation despite the complications a hit-and-run creates.

You do not have to be a rideshare passenger to file a claim after being injured by a rideshare driver. Pedestrians struck while crossing the street absolutely deserve full compensation for their injuries. Cyclists hit when rideshare drivers open doors without looking or turn without checking their mirrors can pursue claims. Occupants of other vehicles involved in accidents with rideshare drivers have the same rights as passengers riding inside those vehicles.

The million-dollar liability policy should cover third-party victims when rideshare drivers are transporting passengers or traveling to pick someone up. Accessing that coverage requires proving what the driver’s app status was at the moment of impact, which is information these companies do not share willingly.

Multiple insurance policies might apply to your claim if you were injured as a third party. The rideshare driver’s personal insurance might provide some coverage if their policy does not completely exclude commercial activity. The rideshare company’s coverage depends on the driver’s app status at the time of your accident. Your own uninsured or underinsured motorist coverage might also apply. Each of these policies creates another potential source of recovery and another potential battle with insurance adjusters.

Pedestrians face particular vulnerability in these accidents because they have no vehicle to protect them from impact forces. Head trauma from hitting the pavement, spinal cord damage from being thrown by the collision, broken bones throughout the body, and internal organ damage are all tragically common. Recovery often takes months or years, and permanent disabilities can change everything about your life going forward.

Jim Adler & Associates fights for all rideshare accident victims regardless of whether you were a passenger, pedestrian, cyclist, or occupant of another vehicle. We pursue maximum compensation from every available source because Jim Adler, The Voice of The Victims™, represents everyone harmed by corporate negligence.

Delayed injuries are extremely common after rideshare accidents, and this pattern is well-documented in medical literature. Adrenaline floods your body immediately after a traumatic event and temporarily blocks pain signals from reaching your brain. You might feel relatively normal at the accident scene and assume you escaped without serious harm. Hours or days later, when the adrenaline finally wears off, the real damage becomes painfully apparent.

Soft tissue injuries are particularly likely to take time before they fully manifest. Whiplash from a violent impact does not always hurt right away. You might wake up the next morning unable to turn your neck. Back pain often develops gradually as inflammation progresses over several days. These delayed symptoms reflect real injuries that require treatment and deserve compensation.

If new pain develops in the days following your accident, see a doctor immediately and explain the connection to the recent rideshare accident. Getting a proper diagnosis and starting treatment creates medical records that document when your symptoms appeared and why treatment was medically necessary. Insurance companies have a much harder time disputing contemporaneous medical records that clearly connect your injuries to the accident.

Jim Adler & Associates works with medical experts who understand delayed injury patterns and can testify about the connection between your accident and symptoms that appeared later. We do not let insurance companies use normal medical timing as an excuse to deny your legitimate claim.

Texas Civil Practice and Remedies Code Section 16.003 gives you two years from the date of your accident to file a lawsuit for personal injuries. This deadline is absolute in most situations, and missing it by even a single day typically means losing your right to compensation forever.

Insurance companies know about this deadline and sometimes deliberately delay the claims process to run out the clock on your case. They request endless documentation, drag out negotiations, and dispute coverage determinations while time keeps passing. They benefit when you miss your deadline because they no longer owe you anything at all.

Filing deadlines for insurance claims work differently from lawsuit deadlines and can catch people off guard. Your rideshare company or the driver’s insurance policy might require notification within just days of the accident. Failing to provide prompt notice according to policy terms can jeopardize your coverage and limit your options for recovery.

Jim Adler & Associates protects all of your case-specific deadlines from day one. We track every filing requirement, handle all notifications properly, and make sure insurance companies cannot use time as a weapon against you while you focus on your recovery.

Jim Adler & Associates handles rideshare accident cases on a contingency fee basis, which means you pay nothing out of pocket to get started. If your case settles without filing a lawsuit, our fee is 35% of the recovery. If we need to file a lawsuit to fight for fair compensation, the fee is 40% of the recovery. We advance all case expenses ourselves, including investigation costs, expert witness fees, medical record retrieval, and court filing fees.

You pay no fee at all unless we recover compensation for you.* This structure levels the playing field against billion-dollar corporations that have nearly unlimited legal budgets. They cannot outspend you when Jim Adler, The Texas Hammer®, is fighting on your side. We invest our own money in your case because we believe in it, and our financial interests align completely with yours because we only get paid when you do.

Uber, Lyft, and similar companies have spent millions of dollars fighting to keep their drivers classified as independent contractors rather than employees. This distinction protects corporate profits while eliminating protections that workers in other industries take for granted. There is no workers’ compensation coverage when a rideshare driver gets hurt on the job. There are no unemployment benefits, no employer-provided health insurance, and limited corporate liability for driver actions.

The independent contractor classification creates dangerous coverage gaps after accidents. If you are a rideshare driver injured while working, you cannot access workers’ compensation benefits to cover your medical bills and lost wages. Your personal auto insurance might deny your claim because most policies exclude commercial driving activity. The rideshare company’s coverage depends entirely on your precise app status at the moment of the accident. These gaps in protection exist by design, and injured drivers fall through them constantly.

Texas courts have generally accepted the independent contractor classification even though companies exert significant control over how drivers operate. Courts focus on the fact that companies do not set specific work hours, do not dictate driving routes, do not provide vehicles, and do not directly supervise daily operations. These factors have been enough to maintain the contractor designation in most legal challenges.

This classification does not eliminate all company liability, however. Negligent hiring claims still apply even when workers are contractors, and companies must adequately screen drivers before approving them for the platform. Background checks that miss serious red flags or failures to verify driving records can create direct liability when dangerous drivers cause accidents.

The independent contractor defense also does not protect companies from their own negligent actions. App designs that create dangerous distractions, surge pricing that encourages speeding, and rating systems that pressure drivers to prioritize speed over safety all contribute to accidents. When the company’s own choices contribute to someone getting hurt, they cannot simply hide behind contractor status.

Jim Adler, The Texas Hammer®, holds these companies accountable when they profit from systems that put people in danger.

Coverage disputes become especially intense when accidents occur during pickup or drop-off. Insurance companies argue about whether the ride had officially begun or already ended. They claim the driver was not actively transporting a passenger at the moment of impact. They fight to apply lower coverage limits or deny claims entirely based on technicalities about timing that can come down to seconds.

The driver’s app status determines which coverage applies to your accident, but proving that status becomes a battle. Rideshare companies control this data and will not voluntarily hand over information that triggers their million-dollar liability policy. They hide behind claims of privacy concerns and proprietary system protection. Without this evidence, you cannot prove which coverage should pay for your injuries.

Accidents while getting into rideshare vehicles raise unique liability issues that insurance companies try to exploit. Drivers sometimes choose unsafe pickup locations that force passengers to navigate dangerous traffic. They pull into active traffic lanes instead of pulling to the curb. They make passengers cross busy streets to reach the vehicle. They open doors for cyclists or motorcyclists without checking first. These dangerous practices cause injuries that companies then try to blame on the passenger’s choice to board at that location.

Accidents while exiting vehicles involve similar problems. Drivers stop in dangerous locations where passing traffic creates hazards for exiting passengers. They fail to warn passengers about traffic before they open the door. They do not leave sufficient space between the vehicle and the curb. They rush passengers out of the vehicle to complete rides faster and move on to the next fare. Each of these dangerous practices results from company pressure to maximize the number of rides completed.

Accidents involving vehicle doors are particularly devastating for cyclists. Passengers open doors without checking mirrors, and cyclists riding in designated bike lanes have no warning. The impact throws them into traffic, and catastrophic injuries result from behavior that was entirely preventable.

Jim Adler & Associates investigates the exact timing and circumstances of accidents that happen during pickup and drop-off. We force disclosure of app data that proves active ride status. We show how company policies and app design contribute to dangerous practices. We pursue maximum compensation regardless of exactly when during the ride your accident occurred.

After a rideshare accident, you need time to recover from your injuries and focus on getting your life back on track. You should not have to battle multiple insurance companies and billion-dollar corporations while dealing with pain, medical appointments, and the stress of everything that has happened to you.

Jim Adler & Associates has been fighting for injured Texans for more than 50 years. We know exactly how rideshare companies and their insurers try to avoid paying what they owe, and we know how to hold them accountable. When Uber, Lyft, and their insurance adjusters try to deny your claim or offer you far less than you deserve, Jim Adler, The Texas Hammer®, fights back.

We serve clients in English and Spanish across Texas, so call now for a free consultation.* You pay no fee unless we recover compensation for you.*

[1] Insurance Research Council. (1999). Paying for auto injuries: A consumer panel survey of auto accident victims. Insurance Research Council.

[2] Verkhivker, A. (2018, November 15). Is ride-sharing killing people? Yes, study suggests, but critics are doubtful. Science. https://www.sciencemag.org/news/2018/11/ride-sharing-killing-people-yes-study-suggests-critics-are-doubtful

[3] Morrison, C. N., Kirk, D. S., Brazil, N. B., & Humphreys, D. K. (2022). Ride-hailing and road traffic crashes: A critical review. American Journal of Epidemiology, 191(10), 1632-1645. https://pmc.ncbi.nlm.nih.gov/articles/PMC9431654/

[4] Harvard Medical School Division of Sleep Medicine. (n.d.). Judgment and safety. Healthy Sleep. https://sleep.hms.harvard.edu/education-training/public-education/sleep-and-health-education-program/sleep-health-education-89

[5] Texas Insurance Code, Chapter 1954. Insurance for Transportation Network Company Drivers. https://statutes.capitol.texas.gov/Docs/IN/htm/IN.1954.htm

Hurt in an accident? Tell us what happened. We’ll give you straight answers — fast, free, and with no strings attached.*

Address

2711 North Haskell Ave.

Suite 2500

Dallas, TX 75204

Address

1900 W Loop S

20th Floor

Houston, TX 77027

Address

12605 East Freeway

Suite 400

Houston, Texas 77015

Address

7330 San Pedro Ave

Suite 700

San Antonio, TX 78216